Showcase – UX/UI

Personal Expenses Dashboard

Background

Managing personal finances is a challenge for many individuals, especially in today’s fast-paced and increasingly complex financial landscape. As people juggle various income streams, bills, and personal goals, having a clear, visual representation of their financial behavior is crucial. This dashboard was created to address the common problem of budget management and financial awareness, offering an intuitive, easy-to-navigate tool for individuals to monitor, analyze, and optimize their spending habits.

Goals

- Transparency and Clarity: Provide users with a comprehensive overview of their personal expenses, enabling them to understand spending patterns at a glance.

- Data-Driven Decision Making: Empower users with actionable insights derived from their financial behavior, promoting smarter budgeting and improved financial habits.

- Expense Optimization: Help users identify areas where they can cut unnecessary spending and optimize their budgets to achieve their financial goals.

- User Empowerment: Allow users to take control of their financial lives, with features such as customizable budgets, real-time updates, and AI-powered recommendations.

The Problem It Solves

Many individuals struggle with tracking and managing their personal finances. Traditional spreadsheets or scattered bank statements provide little context or insight into spending trends, making it difficult to plan effectively. Common challenges users face include:

- Lack of insight: Users have no clear picture of where their money goes.

- Inefficient tracking: Manual tracking or piecemeal methods fail to provide an actionable overview.

- Budgeting frustration: Without clear data, it’s difficult to stick to a budget, leading to overspending in categories that could be easily reduced.

The Personal Expenses Dashboard addresses these pain points by offering a centralized platform to visualize spending, track budgets, and receive tailored insights, all in real-time.

The Personal Impact

By utilizing this dashboard, users gain clarity and control over their financial health. The ability to track expenses, set realistic goals, and receive proactive suggestions leads to more mindful spending, resulting in potential savings, reduced financial stress, and an empowered financial future. The dashboard doesn’t just highlight where money is being spent, it actively encourages smarter decision-making, ultimately contributing to a more secure and balanced financial life.

Research

Methods Used

- User Interviews: Direct conversations with potential users helped pinpoint pain points and unmet needs.

- Surveys: A broad set of questions was distributed to gather quantitative data on user behaviors and preferences.

- Competitive Analysis: Studied leading personal finance apps and dashboards to evaluate what works and what could be improved.

Goals of Research

- Understand user pain points: Identify the main financial challenges faced by the target demographic.

- Market trends: Assess existing solutions and gaps in the personal finance management sector.

- Behavioral insights: Uncover how users engage with financial data and what features they find most valuable.

Competitive Research

Existing solutions, such as RiseUp, Mint, YNAB (You Need A Budget), and PocketGuard, offer similar functionalities but often lack deep customization or fail to provide actionable insights in a user-friendly manner. The Personal Expenses Dashboard differentiates itself by:

- Offering personalized recommendations based on real-time financial data.

- Featuring easy-to-understand visualizations with interactive elements.

- Including predictive tools for future expenses based on past behavior.

Customer Quotes and Unmet Needs

“I have no idea where my money goes each month. I use a budgeting app, but it’s hard to understand which categories I’m overspending on.”

“I wish I could get personalized recommendations on how to reduce my spending. I know I could save more, but I don’t know where to start.”

“Tracking expenses on spreadsheets feels so overwhelming. It’s time-consuming and doesn’t give me a good overview of my financial habits.”

Personas

Sarah, The Millennial Professional

Age: 28

Occupation: Marketing Manager

Financial Goals: Save for a home, pay off student loans

Pain Points: Struggles with tracking expenses and doesn’t know where her money is going. Feels guilty about overspending but doesn’t have the time to organize her finances manually.

John, The Small Business Owner

Age: 42

Occupation: Entrepreneur

Financial Goals: Keep personal and business finances separate, manage cash flow

Pain Points: Needs to track both personal and business expenses. Finds current tools too generic and time-consuming to use. Wants quick insights to optimize cash flow.

Olivia, The Family Budgeter

Age: 35

Occupation: Teacher

Financial Goals: Save for children’s education and family vacations

Pain Points: Juggling multiple expense categories and feels overwhelmed by her family’s complex financial situation. Needs an easy-to-understand tool to manage both short-term and long-term goals.

Persona Insights and Conclusions

- Sarah: Needs an intuitive, automated system that reduces manual input and provides immediate feedback.

- John: Requires a solution that integrates both personal and business finances, with an emphasis on cash flow management.

- Olivia: Prioritizes simplicity and clear visualizations to make budgeting easier for her family, and seeks tools that help track both small and large financial goals.

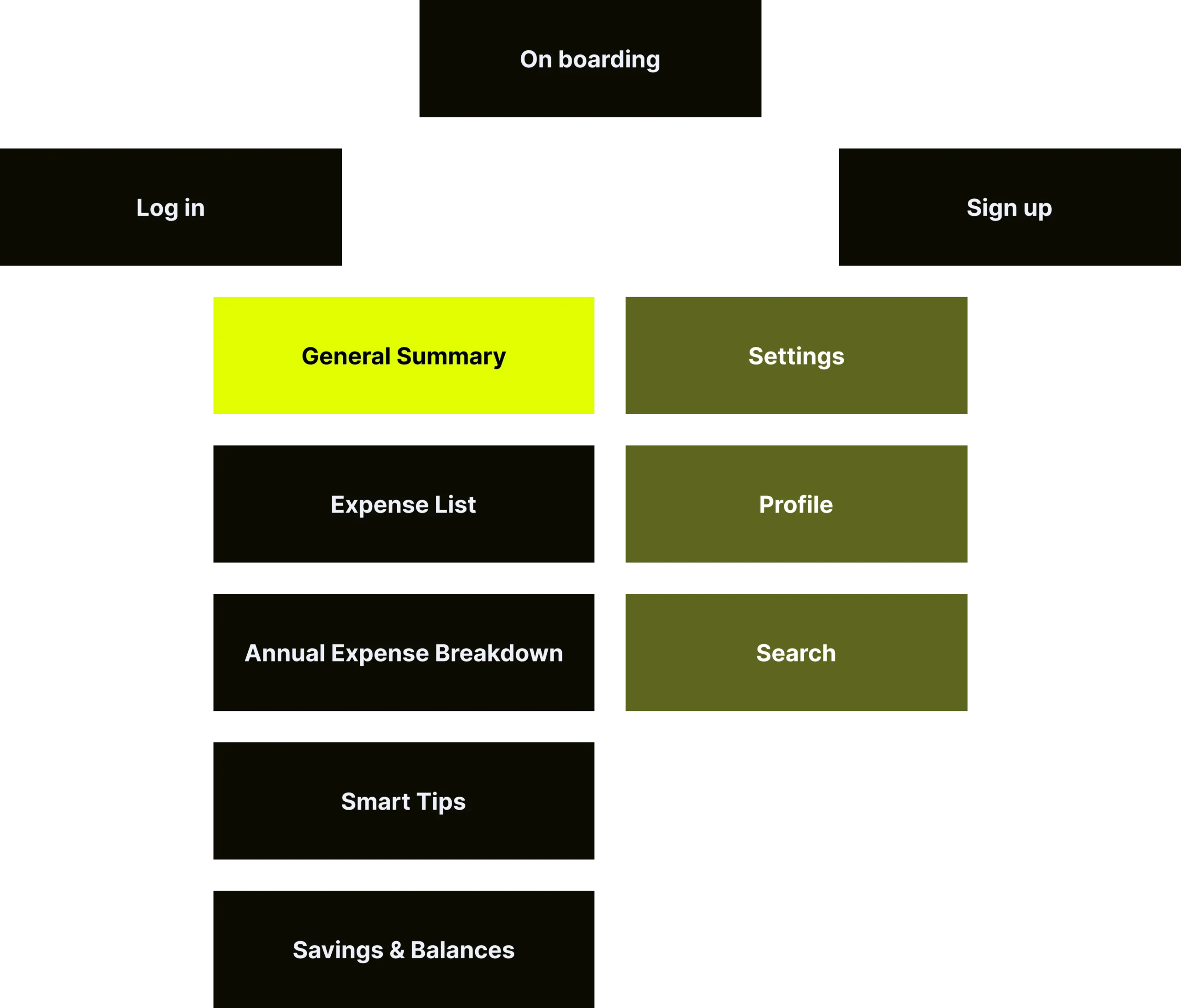

Dashboard Flow

Final UX

Branding

Colors

Primary colors

E0FE01

0C0B03

FFFFFF

Secondary colors

Gradient

96A338

494949

333325

01AAFE

Font

Montserrat SemiBold - 40 H1

Montserrat SemiBold - 32 H2

Montserrat SemiBold - 20 H3

Montserrat - 16 TEXT

Montserrat - 14 TEXT

Montserrat SemiBold - 16 button

Final UI